Latest Transportation News from around the world

Large Refer Vessel Launched

The launch of a large refrigerated cargo vessel by Mediterranean Shipping Company (MSC) marks a significant expansion of its Asia-focused shipping fleet and highlights the growing importance of temperature-controlled logistics across regional supply chains. The new high-capacity reefer vessel is designed to transport perishable and sensitive cargo—such as seafood, fresh produce, dairy, and pharmaceuticals—across major Asia-Pacific trade routes with improved efficiency and reliability.

This development reflects MSC’s strategic investment in specialized maritime infrastructure to support rising demand for cold-chain transportation driven by expanding food exports, pharmaceutical manufacturing, and cross-border e-commerce in the region. By adding a dedicated refrigerated vessel to its fleet, MSC aims to enhance cargo capacity, maintain tighter temperature control standards, and reduce transit risks for time-sensitive shipments moving between key markets including India, Southeast Asia, China, and the Middle East.

The vessel’s deployment also signals a broader industry shift toward value-added logistics services, where shipping companies are increasingly integrating advanced refrigeration systems, real-time cargo monitoring, and energy-efficient technologies into their operations. For exporters and logistics providers across Asia, this fleet expansion is expected to improve shipping availability, strengthen cold-chain reliability, and support the continued growth of perishable goods trade across regional and global supply networks.

Large Refer Vessel Launched A major new high-capacity refrigerated vessel was launched, reflecting continued investment in specialized cargo shipping across Asia-Pacific supply chains.

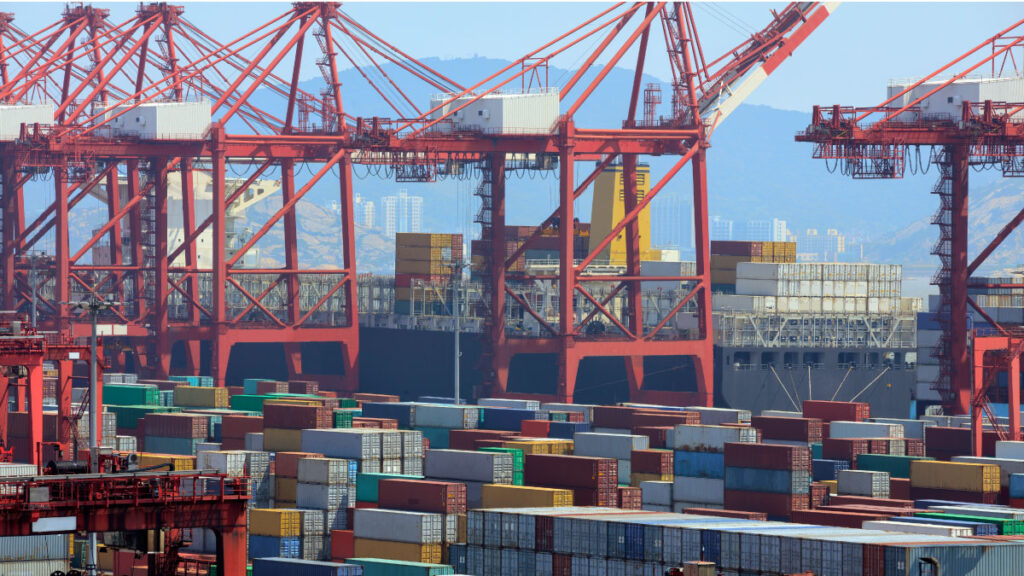

Port Congestion Update....

As of late February 2026, major Asian ports are navigating a complex landscape defined by the Lunar New Year holiday (February 17–23), persistent yard density issues in China, and the lingering effects of global vessel diversions. While overall waiting times in Asia remain significantly lower than the peak “COVID-era” levels, “hidden” congestion in terminal yards is creating operational fragility.

1. Key Performance Metrics (February 2026)

Across the major hubs, waiting times are currently hovering between 1 and 3 days, but yard utilization at several Chinese ports is nearing critical capacity.

| Port | Avg. Waiting Time (Days) | Yard Utilization (%) | Current Status |

| Shekou (China) | 1.5 – 3.0 | 98% | Critical (Extreme gate-in pressure) |

| Ningbo (China) | 2.2 – 3.0 | 96% | High (MSICT terminal stressed) |

| Nansha (China) | 1.6 – 3.5 | 91% | High (Yard density causing delays) |

| Shanghai (China) | 1.8 – 2.5 | 81% | Stable/Moderate (WGQ terminal congestion) |

| Singapore | 1.1 – 1.5 | 80–85% | Busy but Stable |

| Port Klang (Malaysia) | 1.1 – 2.7 | 73% | Improving (Westport delays clearing) |

2. Primary Drivers of Congestion

The “Yard Density” Trap: While vessel queues at sea are relatively short, terminals are physically “choked” on land. In Shekou and Ningbo, yard density above 95% means that moving one container requires shifting several others, drastically slowing down productivity.

Lunar New Year Aftermath: The holiday (Feb 17–23, 2026) has led to a traditional slowdown in trucking and labor. However, shippers “frontloaded” cargo in early February to beat the break, leaving ports with massive backlogs of containers waiting to be loaded.

Carrier “Blank” Sailings: To manage falling freight rates, carriers have cancelled (blanked) a significant number of sailings. Drewry reported 136 cancelled sailings in February 2026 alone—a 122% increase from January. This “vessel bunching” causes a sudden surge of cargo at specific terminals rather than a steady flow.

Suez vs. Cape Diverge: While some carriers have begun a phased return to the Suez Canal, roughly 6% of the global fleet remains diverted around the Cape of Good Hope. The resulting irregular arrival schedules make it difficult for Asian ports to manage berth windows efficiently.

3. Wider Impact & Logistics Risks

Equipment Shortages: Due to delays in Europe and the US caused by winter weather and Red Sea diversions, empty containers are not returning to Asia fast enough. This is creating localized shortages of 40ft High Cube and Reefer (refrigerated) units.

Reliability Decline: Global schedule reliability dropped to 62.8% recently. For shippers, this means “Estimated Time of Arrival” (ETA) is increasingly unreliable, often shifting by 5+ days on long-haul routes.

Increased Costs: Although spot rates have softened to roughly $1,919 per 40ft container (World Container Index), shippers are facing higher “hidden” costs like demurrage and detention fees as containers sit longer in congested yards.

4. Outlook for March 2026

Experts expect a temporary lull in the first two weeks of March as the post-holiday manufacturing restart begins. However, if the Red Sea situation remains volatile and carriers continue aggressive blank sailings, the “hidden” yard congestion in China could easily spill back into sea-side vessel queues by mid-March.

Port congestion and waiting times across major Asian ports Recent operational updates show vessel delays and congestion across ports including Shanghai, Ningbo, Busan, and Port Klang, affecting shipping schedules and turnaround times.

Fire on a Singapore-bound cruise ship

The fire incident on the Singapore-bound cruise ship that passengers later described as a dramatic escape:

🔥 What occurred

A fire broke out early on 20 February 2026 aboard the World Legacy cruise ship, which was sailing toward Singapore.

The blaze reportedly started in a lounge area on deck nine around 4 a.m. local time.

Singapore Civil Defence Force (SCDF) marine firefighters and authorities including the Maritime and Port Authority of Singapore (MPA) responded to extinguish the fire.

🧑🚒 Casualties and evacuations

One crew member, a 23-year-old Indonesian laundry attendant, died after being found collapsed on deck nine; the cause of death was linked to asphyxiation.

All 271 passengers on board were evacuated from the vessel and safely disembarked at Singapore’s HarbourFront Ferry Terminal.

Four passengers were taken to hospital for medical checks. (Mothership)

😨 Passengers’ experience

Several people who were on board described the evacuation as frightening and chaotic:

Passengers said they were woken by alarms and loud knocks on their cabin doors and smelled smoke before being told to move to a muster area.

Many were instructed to go to deck seven and put on life vests, while thick smoke spread to lower decks, forcing them to wait in uncomfortable conditions.

Some stood on deck for several hours (about 4 a.m. to over 9 a.m.) before transfer to rescue boats, enduring cold, wet conditions, exhaustion, and smoke exposure.

Passengers reported feeling scared and uncertain throughout much of the evacuation, describing the experience as “truly terrible and traumatising”. (The Star)

📍 Aftermath

A safety zone was established around the anchored vessel at Raffles Reserved Anchorage while the investigation into the fire’s cause continues.

Singapore authorities are working with the Indonesian embassy regarding the deceased crew member’s repatriation and support to the family.

Fire on a Singapore-bound cruise ship Passengers described a dramatic escape after a fire on a Singapore-bound cruise ship, highlighting ongoing safety risks in regional maritime travel and port-linked cruise operations.

Indonesia’s major carrier platform.

Indonesia is set to acquire the Giuseppe Garibaldi, a 180-meter Italian aircraft carrier decommissioned in 2024, as a grant from the Italian government. Expected to arrive by October 2026, the vessel would make Indonesia one of the few Asian nations, alongside China, India, and Thailand, to operate such a platform. While the move is a cinematic milestone for the Indonesian Navy—which is already ranked among the world’s strongest—the acquisition has sparked a significant debate among maritime experts regarding its practical utility.

Official statements from Jakarta suggest the carrier will primarily be used for “military operations other than war,” focusing on humanitarian assistance and disaster relief rather than combat. However, analysts point out that the Giuseppe Garibaldi lacks a “well deck” to launch the landing craft necessary for moving heavy equipment ashore, potentially limiting its effectiveness in disaster zones. Furthermore, without a clear plan to acquire and integrate specialized carrier-based combat aircraft, critics argue the hull may offer more symbolic prestige than actual strategic power.

A major concern for defense researchers is the immense cost and technical expertise required to maintain such a complex warship. With a crew requirement of around 800 personnel and expensive gas turbine engines, the carrier threatens to drain a defense budget already stretched thin by an aging fleet. Experts warn that the resources used to keep the carrier afloat could be better spent on frigates or patrol boats, which are more urgently needed to provide maritime awareness across Indonesia’s vast and porous archipelago.

Ultimately, there is a looming fear that the Giuseppe Garibaldi could become a “port queen”—naval slang for an impressive ship that remains permanently docked because it is too expensive or impractical to sail. While the carrier could theoretically shift Indonesia’s defense posture toward power projection, its actual impact depends on whether the government can secure consistent funding for operations. Without a robust support system, the ship risks becoming a costly monument rather than a functional asset for regional security.

Indonesia’s consideration of a major carrier platform has sparked debate over maritime infrastructure and port readiness.

New tariff uncertainty

The U.S. Supreme Court struck down many of the aggressive, sweeping tariffs the Trump administration had previously imposed on major Asian trading partners like China, Japan, South Korea, and Taiwan. The court ruled that these levies—originally enacted under a 1977 law meant for national emergencies—were legally overreaching. This effectively cut the average U.S. tariff rate nearly in half, shifting it from roughly 15% to 8%, and provided a sudden, though perhaps fleeting, boost in bargaining power to export-heavy nations like China ahead of major diplomatic summits.

However, the “relief” for these economies was immediately met with a new layer of confusion. Within hours of the court’s ruling, President Trump pivoted to a different legal authority (Section 122 of the Trade Act of 1974) to impose a fresh, temporary 10% global duty on nearly all imports for an initial 150-day period. This move was designed to keep trade barriers in place while his administration launches “legally durable” investigations to justify even higher tariffs in the future. For businesses across Asia, this creates a “fiasco” of unpredictability; they are now operating in a landscape where trade rules are being rewritten in real-time to circumvent judicial setbacks.

Finally, the regional impact is a mix of strategic caution and tactical maneuvering. While nations like Japan and South Korea are “carefully examining” the legal fallout, others are seeing immediate economic side effects. For instance, some shippers in Thailand are racing to “front-load” goods to the U.S. to beat the next wave of threatened hikes, while Hong Kong officials are highlighting their city’s separate customs status as a rare island of stability. Ultimately, the news signals that while the Supreme Court may have limited the President’s initial methods, the underlying trade war remains active, forcing Asian economies to brace for a prolonged period of “trial by tariff” and shifting supply chains.

New tariff uncertainty affecting Asian trade flows and shipping Fresh tariff uncertainty is influencing Asian trade expectations, which could reshape cargo volumes and shipping demand through regional ports.

Lunar New Year manpower shortages

Lunar New Year (Chinese New Year), which in 2026 fell on Tuesday, February 17, represents the single most disruptive annual event for global supply chains. Here is the breakdown of why it is featured in the news item:

1. Timing and Duration

The Official Break: In 2026, China’s official public holiday was observed from February 15 to February 23. During this week, government offices, customs, and most businesses were officially closed or operated with skeleton crews.

The “6-8 Week” Impact: Although the official holiday is only a week, the Kuehne+Nagel update reflects a much longer operational window. Factories typically begin winding down production 2–3 weeks before February 17 as workers travel home, and they do not return to full capacity until mid-March.

2. Impact on Port Operations (The “Yard Density” Issue)

The update highlights high yard utilization (often 90–98%) at major ports like Ningbo, Nansha, and Shekou. This is a direct result of the holiday cycle:

Pre-Holiday Rush: In the weeks leading up to February 17, exporters scrambled to “gate-in” as many containers as possible before factories closed. This flooded port terminals, leading to the “saturated” conditions mentioned in the news.

Labor Shortages: During the holiday (which includes the date of the news item, Feb 19), there is a severe shortage of truck drivers and port labor. Containers sit longer in the yard because there are fewer people to move them, driving yard density to critical levels.

3. Impact on Shipping Schedules

Blank Sailings: Because manufacturing stops almost entirely during the holiday, there is very little new cargo to pick up. Shipping lines respond by “blanking” (canceling) sailings.

Vessel Bunching: The irregular schedules caused by these cancellations lead to “vessel bunching,” where multiple large ships arrive at once after the holiday, further straining the already congested ports as they attempt to clear the backlog.

Lunar New Year manpower shortages impacting Asian ports Several Asian countries suspended or slowed port operations during the Lunar New Year, leading to manpower shortages and reduced vessel productivity.

Asia maritime defence deployment

The Russian Navy has launched a significant Surface Action Group (SAG) deployment to the Asia-Pacific region, signaling Moscow’s continued focus on projecting power in the Far East. Led by the Pacific Fleet, the mission involves a contingent of modern corvettes, including the Steregushchiy-class vessels Gromkiy and Sovershennyy. The group departed from its primary base in Vladivostok to conduct a series of long-range patrols and tactical maneuvers aimed at protecting Russian maritime interests and demonstrating a persistent naval presence in strategic waters.

During the transit, the task force is scheduled to conduct a comprehensive suite of combat drills designed to test readiness in high-tension environments. These exercises include anti-submarine warfare (ASW) simulations, air defense coordination, and specialized training to repel attacks from unmanned aerial vehicles (UAVs) and surface drones. By integrating these modern “gray zone” threats into their training curriculum, the Russian crews are refining their ability to protect the fleet against the evolving technological challenges seen in recent global maritime conflicts.

This deployment has drawn close scrutiny from regional neighbors, particularly Japan, which has increased its surveillance of the Russian vessels as they move through critical chokepoints like the La Pérouse and Tsugaru Straits. The move comes at a time of heightened geopolitical sensitivity in Northeast Asia, as Russia seeks to deepen its security footprint and maintain its status as a major Pacific power. The ongoing mission underscores the strategic importance of the Sea of Japan and the broader Indo-Pacific as a primary theater for Russian naval diplomacy and military readiness.

Asia maritime defence deployment impacting regional sea lanes Naval deployments in the Asia-Pacific are shaping maritime traffic and security dynamics along key sea lanes used by commercial shipping.

The regional ocean freight markets

The Asia-Pacific logistics landscape in February 2026 is defined by a complex “transition phase” where market movements are driven more by strategic capacity decisions and regulatory shifts than by broad demand recovery. While the traditional pre-Lunar New Year rush provided a temporary volume bump, manufacturing signals across the region remain fragile and uneven. High-tech sectors—specifically semiconductors, AI hardware, and e-commerce—continue to dominate outbound airfreight from hubs like Hong Kong and Singapore, whereas consumer-led and inventory-heavy markets are seeing much softer momentum.

In the maritime sector, ocean freight is navigating a period of cautious adjustment. Global container capacity is expanding, but carriers are aggressively repositioning assets; capacity has shifted toward Asia-Europe and Middle Eastern lanes, while Transpacific growth has slowed. Despite a temporary trade truce between the U.S. and China that has lowered some tariffs, shippers remain wary of underlying geopolitical instability. Furthermore, the potential for a full return to Red Sea transits looms as a “wildcard” that could reintroduce excess capacity into an already fragile market, keeping spot rates under pressure despite sustained operational costs.

Regulatory compliance has moved from the periphery to the center of logistics strategy this month. U.S. authorities have intensified enforcement against illegal transshipment and tariff evasion, while Mexico has implemented new tariffs and stricter origin verification for Chinese-origin goods. These developments, combined with new restrictions on foreign-manufactured technology (such as drones), mean that routing and documentation accuracy are now as critical to the “landed cost” as the freight rate itself. For logistics leaders, the focus for the remainder of Q1 2026 is on lane-specific risk management rather than generic volume growth.

The regional ocean freight market is navigating post-holiday slowdowns and fluctuating rates across Asia-Pacific routes.